Nigerian billionaire and business mogul, Femi Otedola, has revealed the harrowing financial ordeal that cost him nearly N200 billion, describing it as one of the darkest moments of his entrepreneurial journey….CONTINUE FULL READING>>>>>

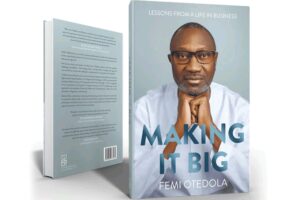

In his new memoir, Otedola: An Autobiography, the chairman of FBN Holdings Plc recounted how a mix of global oil market volatility and financial miscalculations brought his energy empire, Zenon Petroleum & Gas, to its knees.

The Oil Price Collapse

According to Otedola, the crisis began in 2008 when global crude oil prices peaked at $147 per barrel. Believing the upward trend would continue, he made a bold move—placing a diesel import order worth $500 million for the Nigerian market.

However, within weeks, oil prices plummeted to $37 per barrel, slashing the value of his cargo to a fraction of the purchase price.

“The diesel I ordered at the peak of the market was already on the high seas. By the time it landed, the value had collapsed. At that point, I told myself—this is the end,” Otedola recalled.

Naira Devaluation and Mounting Debt

As the oil market crash deepened, Nigeria’s foreign exchange crisis compounded his woes. The Central Bank of Nigeria devalued the naira due to dwindling oil revenues. Loans that Otedola had secured at N117/$1 were now to be repaid at N165/$1, inflating his debt significantly.

“I saw N60 billion wiped out instantly, alongside another N40 billion in interest repayments,” he revealed.

A Missed Stock Market Exit

The billionaire also disclosed how his investments in Nigeria’s banking sector further worsened his losses. At the time, Otedola held 2.3 billion shares in Zenith Bank, representing about 8% ownership, and an additional 6% stake in UBA.

He purchased Zenith Bank shares at N12 each and saw them surge to N60. A timely exit could have earned him a staggering N191 billion. However, expecting the rally to continue, he held on—only for the global financial crisis to strike, erasing much of his paper wealth.

“It remains one of my deepest regrets. If only I had trusted my instincts and sold at the peak,” he admitted.

AMCON Intervention and Asset Surrender

By the end of the crisis, Otedola’s debts had soared to over N220 billion. To resolve the financial quagmire, he reached an agreement with the Asset Management Corporation of Nigeria (AMCON), the government agency established to rescue banks from toxic loans after the 2008 crash.

As part of the settlement, Otedola relinquished substantial assets, including luxury estates in Lagos, Abuja, and Port Harcourt, filling stations nationwide, truck depots, storage facilities in Apapa, his holdings in banks and oil firms, and even his Bombardier private jet.

“It was a lifeboat in the storm,” he wrote. “You either sink with pride or grab a preserver to stay afloat. I chose the latter and gave up everything to start all over again.”

Lessons Learned and a New Beginning

Looking back, Otedola described the experience as a turning point that reshaped his outlook on business and life. Losing almost everything, he said, instilled discipline and a renewed determination to rebuild.

Today, Otedola has not only recovered but also cemented his place as one of Nigeria’s most influential investors. As chairman of FBN Holdings Plc, he remains a prominent figure in the nation’s corporate and financial landscape.

His newly released memoir, Making It Big, published on August 18, 2025, provides a candid look into his rise, fall, and comeback….CONTINUE FULL READING>>>>>